LA-area fire victims demand resignation of state's top insurance regulator

Published in Business News

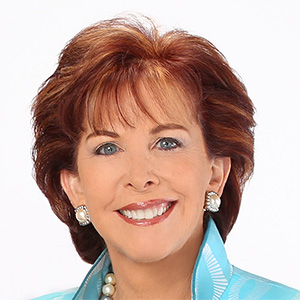

Victims of the January wildfires in Los Angeles County urged Gov. Gavin Newsom on Thursday to call for the resignation of California Insurance Commissioner Ricardo Lara, saying the regulator has allowed insurers to run roughshod over them.

Lara, an independently elected state official, was accused at an Altadena news conference of being too closely aligned with the interests of insurers who homeowners say have delayed, denied and lowballed claims, forcing victims to tap retirement accounts and max out credit cards as they fight for their benefits.

"Gov. Newsom, we need your help. Your Palisades constituents have your back. Now is the time for you to have ours," said Jill Spivack, 59, a Pacific Palisades resident whose home of 25 years burned down but who has yet to start rebuilding.

"You made promises when the cameras were rolling," Spivack added. "Now we need to see your actions behind those words. Commissioner Lara has proven he won't protect consumers. Please replace him with someone who will."

The event, attended by several dozen Altadena and Pacific Palisades fire victims, was held by the Eaton Fire Survivors Network and attended by other groups, including the Los Angeles insurance advocacy group Consumer Watchdog, which called on Lara to resign last year.

Joy Chen, executive director of the network, cited recent surveys that found 70% of insured survivors have encountered delays and denials, while 8 in 10 Eaton and Palisades fire survivors are still displaced. The fires damaged or destroyed nearly 13,000 homes.

"We have an unprecedented housing crisis on our hands, which grew out of the insurance crisis on our hands," Chen said. "That is why it is so urgent that Gov. Newsom act now."

Newsom's press office did not immediately respond to a request for comment. A spokesperson for Lara —whose term expires in 2026 — rejected any suggestion he would resign.

"The facts are Commissioner Lara has moved quickly and decisively to respond to the fires, including using every tool available to ensure wildfire survivors receive all the benefits they are entitled to under current law," said Michael Soller, the department's deputy commissioner of communications.

On Saturday, Lara had posted on X, "I'm here to finish the job — and leave the next Commissioner in a stronger position than I inherited."

To advance its goals, the Eaton network established a website — lararesign.org — where fire victims and others can send emails to the governor and Lara asking for the commissioner's resignation and leaving comments.

Much of the anger from fire victims has been directed at State Farm General, California's largest home insurer, which dropped tens of thousands of policyholders in recent years and has been the target of complaints about its claims handling.

Spivack, who said her home on Aderno Way has been insured by State Farm for decades, said that it has been a full-time job getting her personal property claims paid amid changing adjusters and other issues.

Meanwhile, she has been haggling with the insurer for months after getting an estimate of only $250 a square foot to rebuild her home, less than a third of the going rate.

"At first we thought, thank goodness we have insurance. We've been loyal State Farm customers for 25 years," Spivack said. "We trusted their promise to help us rebuild like a good neighbor. But what we faced instead is confusion, lowball estimates and a delay at every turn."

Altadena resident Branislav Kecman, 64, who lost his Crescent Drive home of 12 years in the fire, said he was dropped by State Farm in July 2024 and forced onto the FAIR Plan where his coverage dropped from $1.5 million to $1 million but got more expensive.

"We really feel betrayed by our system, especially our commissioner that's supposed to fight for our interest instead of, so to speak, being in bed with the insurance companies," he said.

Bob Devereux, a State Farm spokesperson, said the insurer has handled more than 13,500 claims and paid almost $5 billion to January wildfire victims, with nearly 200 claim adjusters still on the ground.

"State Farm is committed to paying customers what they're owed. We're here every step of the way and working with elected officials to build a more sustainable insurance market in California," he said.

Chen and Carmen Balber, executive director of Consumer Watchdog, also accused Lara of exacerbating the state's insurance crisis through loopholes in his Sustainable Insurance Strategy, which was backed by the governor.

The regulatory changes gave insurers concessions, including the right to charge homeowners for reinsurance, in exchange for a pledge to write more policies in fire-prone neighborhoods.

However, since the deal was announced in 2023 insurers have dropped hundreds of thousands of homeowners onto the FAIR Plan's rolls, as The Times has reported.

Chen advocated for a new insurance commissioner to adopt a five-point plan developed by the Eaton group to improve the insurance market and oversight of insurers.

That plan includes finishing an investigation into State Farm's claims practices started this year by the department within 60 days — and freezing any rate hikes for the insurer until the claims issues are resolved. (Lara's stance has been that the two issues are legally separate matters.)

Other elements of the plan include ending denials by the FAIR Plan of smoke damage claims — another issue the department is investigating — and preventing "illegal cuts'' in temporary housing benefits while survivors rebuild.

Soller said the department is already working on the various matters raised.

©2025 Los Angeles Times. Visit at latimes.com. Distributed by Tribune Content Agency, LLC.

Comments